Company Overview

ARA Logos Logistics Trust (ALOG) has 30 logistics properties (10 in Singapore, 20 in Australia) and stakes in two property funds. Based on its latest 1Q 2021 business update, 73% of its gross revenue is derived in Singapore while 27% is derived from Australia. Based on its FY 2020 DPU of 5.25 cents, it is trading at a 12M trailing distribution yield of 6.6%.

ALOG's business model is like any other REIT where it collects rental income as the landlord from its tenants. Its tenants are a mix of third-party logistics players or 3PLs (eg. DHL, FedEx) and end-users like ST Engineering. After collecting rent, it would have to pay certain property expenses like property manager fees and leasing commissions. Historically, Net Property Income (NPI) margins have been hovering around 75%. After property-level expenses, we have to take out REIT-level expenses like REIT Manager fees and also remove borrowing costs to derive a net income. From this net income, non-cash items are added back to get the income available for distribution to unitholders.

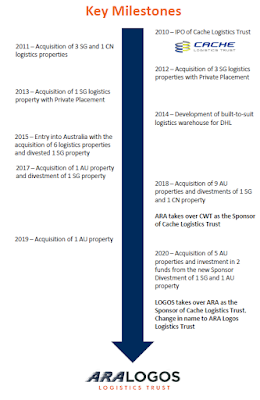

History

ALOG was listed in 2010 as Cache Logistics Trust (CACHE) with 6 properties that were master leased to its sponsor back then, CWT. Over the years, as shown in the diagram below, CACHE has acquired properties almost every year. In recent years, acquisitions have trended towards Australia to increase its exposure to freehold assets as management recognised that the declining land leases in Singapore could lead to valuation declines.

In 2018, ARA took over as the sponsor of CACHE as CWT sold off its stakes in the REIT and REIT Manager. As the master leases from CWT expired, they were not renewed and this led to a decline in occupancy as master-leased properties were converted into multi-tenanted properties. Rentals were also affected as master lease rentals were above market rents at the time.

Reducing exposure to CWT was also opportune as CWT defaulted on its loans in 2019; this was also somewhat linked to financial troubles at HNA Group, which bought over and delisted CWT in 2017. I understand that there have been no defaults on rentals by CWT and CWT only contributed 2.2% of gross rentals in 1Q 2021.

In 2020, there was another change in sponsor as LOGOS was made the sponsor after ARA bought over LOGOS and made LOGOS its logistics arm. Ultimately, ARA is still in control here. This also led to the change in name from CACHE to ALOG.

1. New sponsor to provide development expertise and US$11.4b acquisition pipeline

The new sponsor LOGOS has 111 assets in APAC worth US$11.4bn. This provides ALOG with an acquisition pipeline that it did not really have with ARA before. As ARA is more of a fund manager, the new development expertise that LOGOS brings could also help with asset enhancements and redevelopment. Being a logistics-focused developer also implies LOGOS would have tenant partnerships with a broader range of logistics players.

|

| LOGOS AUM (Source: ALOG) |

I think this provides more visibility on inorganic acquisitions for ALOG. Apart from direct acquisitions, being under the LOGOS umbrella would also give ALOG an implied first look at certain fund investments. This materialised in its latest acquisition in 2020 where ALOG invested in two funds, one of which was managed by LOGOS.

2. Future-ready assets with built-in escalations provide good organic growth visibility

In Singapore, 8 out of ALOG's 10 assets are ramp-up warehouses which tend to command a premium compared to older cargo-lift warehouses. These ramp-up warehouses support 3PL operations as it allows delivery trucks to drive up to the higher floor warehouses to load/unload goods as opposed to unloading on the first floor and taking a cargo lift to higher floors. This results in rentals of higher floors being more comparable to the first floor.

In Australia, its leases have built-in rental escalations of 1-4% which provide very good visibility in terms of organic growth. According to JLL, rental growth is expected to outpace inflation over the next 10 years allowing logistics real estate to deliver real (inflation-adjusted) growth.

|

| Australia logistics rental |

3. Attractive yield spread over alternatives and historical mean

ALOG also has an attractive yield spread of at least 230bps over investment alternatives. While some of it is due to the liquidity premium (vs MLT) or issuer risk (vs CPF SA/MAS10Y), I think that the yield spread should be much smaller, maybe 100-150bps instead. In my opinion, the compression in yield spread should be a result of the stronger growth potential due to its smaller base compared to MLT and 0 growth compared to CPF SA/MAS10Y.

|

| Yield spread comparison |

Compared to its own historical trading yield, ALOG is also trading at >+1SD above its historical mean. I think it should actually be around the -1 SD level instead as it currently has a better growth outlook from its new sponsor. Additionally, in 2019, there were concerns over its exposure to CWT as CWT had just defaulted on a loan.

|

| ALOG forward trading yield (Source: UOBKH) |

Potential concerns

Trading at 6.6%, ALOG may find it difficult to make DPU accretive acquisitions as cap rates continue to compress especially in Australia. This difficulty materialised in its latest acquisition at end-2020 when it made a DPU dilutive acquisition of 5 properties and fund investments. The messaging from ALOG was that it was 'biting the bullet' this once in order to reset its growth trajectory. Without this, it would have been stuck in a vicious cycle of not being able to acquire and grow. Thus far, investors have given them the benefit of doubt and share price has improved since the announcement.Another concern would be the declining land leases of its Singapore assets. ALOG has 2 assets that have <15 years left on their land leases. Gul Logiscentre has 12 years left and contributes about 2% of revenue. I think ALOG could divest this asset and recycle the capital into freehold assets abroad. As for Commodity Hub which has 14 years left, ALOG is likely to hold on as it is their 'crown jewel' contributing 22% of revenue and being one of the largest warehouses in SE Asia. Due to its specifications, I think JTC is likely to renew its lease when the expiry comes.

FYI I'm not vested in ALOG.