I recently read an article in TheEdge talking about how the company with the largest market cap in Singapore is not DBS. Instead, it has been replaced with SEA Ltd which is listed on the New York Stock Exchange. Sea has taken over the mantle of most valuable publicly-traded Singaporean company from DBS which has held it since taking over from Singtel in 2017.

|

| Share price growth of Sea (Source: Google) |

As shown in the figure above, the share price of Sea is currently up 171.1% YTD while DBS is down 19%. According to TheEdge, Sea already overtook DBS in May and the gap between Sea and DBS has widened ever since with Sea being worth $10bn more than DBS based on market cap in mid-June. Interestingly Sea has yet to turn a profit while DBS made $1.2bn in the most recent quarter.

From an economic standpoint, DBS is a key pillar of the Singaporean economy and facilitates the flow of funds as a financial intermediary. On the flip side, Sea is most known for its e-commerce platform Shopee and its gaming platform Garena. Needless to say, the economy can survive without Sea's services but DBS is likely to be deemed 'too big to fail' from a Singaporean context. Sea's valuation has benefited from a few factors

NYSE vs SGX

Sea is listed on the NYSE and has an average trading volume of 5.2m shares which translates to around US$560m of Sea shares changing hands daily. For DBS, its average trading volume is 7.6m, translating to S$160m of DBS shares being traded. If we standardize the currencies, this implies that Sea has a trading value of almost 5x that of DBS!

With a much bigger market in the US, Sea can command a higher valuation than it would have if it had listed on the SGX. I believe this is also one of the reasons why another homegrown tech company, Razer chose to list in Hong Kong rather than in Singapore. The Singapore equity market just isn't vibrant enough to give companies good valuations.

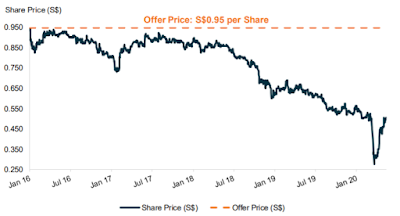

With the crash in share prices, we are probably going to see more delistings/privatizations to come. Although the negative impact to SGX market vibrancy is offset by the increased interest in the share market as bargains emerge. In my earlier article, 'Stay at home and buy stocks', I thought that with the lockdowns, people didn't have much else to do so trading stocks could be a good distraction.

Exposure to the broader economy

Banks are deeply embedded in the economy and hence are impacted when the economy goes into a recession. In comparison, Sea has been an indirect beneficiary of Covid19 with more customers shopping online and lockdowns keeping people at home playing games. A key point to note is that Sea continues to turn a loss year after year while DBS has a quarterly profit of ~1bn on average. With conditions being ripe for Sea, the optics wouldn't be good if it still can't turn a profit or at least narrow its losses in the coming quarter.

Operating leverage

From an operating standpoint, a software/platform company should have a much higher operating leverage compared to a bank since the additional cost of providing the game/platform to an additional user is negligible. After accounting for the fixed costs of hiring staff and setting up infrastructure, any additional revenue tends to flow directly to the bottom online. For a bank, providing an additional loan usually implies going to the money markets to get funds and getting charged a 'cost of funds'. Therefore, I believe that Sea has far more scalable products compared to DBS and hence it is according a higher multiple. This can also be seen in the US where the biggest companies are in tech while the Wall Street banks are lagging.

Overall, I believe that the outperformance of Sea over DBS may continue until the Covid-19 situation dies off and the economy recovers. In the near term, DBS could see further weakness as government support of the economy comes off and businesses and households start to really feel the pain. Globally, the Fed has already announced that it would continue to keep interest rates low and this is a definite negative for banks' net interest margins.