Analysis of Perennial privatization deal and what's next

The market turmoil induced by Covid-19 has depressed stock prices to the point where sponsors/shareholders feel that the value of their investments would be better realized in the private markets. Earlier this week, a consortium comprising some of Perennial Real Estate Holdings Limited's substantial shareholders announced a voluntary conditional cash offer to privatize and delist PREH at a price of S$0.95 in cash.

This article will breakdown the terms of the deal, deal rationale and next steps for existing shareholders and potential traders.

Terms of the deal

The consortium currently owns 82.43% of PREH and other shareholders will receive S$0.95 in cash for each share owned. Non-consortium shareholders that accept the offer will still be entitled to receive the final dividend of 0.20 cents per share for FY19.

The offer is conditional on the consortium receiving enough acceptances to give it at least 90% stake in PREH, following which it will exercise its right to compulsorily acquire all the remaining shares and delist PREH. Overall this seems like quite a straightforward deal as it is a straight-up cash offer pending shareholder acceptances.

Based on the stake (17.57%) that minority shareholders have, this would imply that less than half of these shareholders are required to accept the offer for it to become unconditional; the consortium requires an additional 7.57% stake in order to hit the 90% mark.

Why the deal is happening?

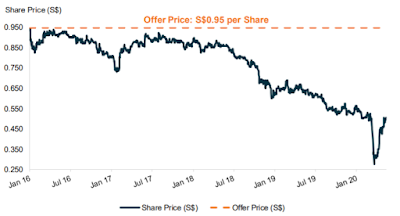

1. Allows minority shareholders to exit their investment at a premium without incurring brokerage fees. The last time PREH was trading at $0.95 was around Jan2016. Since then it has trended downwards and last closed at $0.69 on Friday.

|

| PREH share price (Source: PREH) |

2. Greater flexibility in management. Privatizing the company can free up resources to focus on PREH's strategic objectives rather than pandering to shareholders and the market's short-term whims and fancies. Additionally, a privatized PREH can save on expenses related to maintaining the listing.

3. Support future capital raising. The current low share price of PREH makes it difficult for PREH to raise capital from the equity markets without significantly diluting shareholders' interests. From the announcement, it seems like the consortium wants to secure a new long-term capital partner possibly at a better valuation from what the market is according to it now. This push for new investors and partners is also supported by their recent partial divestment of their stake in AXA Tower to link up with Alibaba.

Analysis of the deal and what shareholders should do

The deal prices PREH at 0.6x to its last declared NAV of S$1.584 per share. I believe that the discount would be even larger if we use a revalued NAV (RNAV) as some of its stake in assets were recently divested (111 Somerset and AXA Tower). The consortium is definitely getting excellent value in their privatization offer at a >40% discount.

While current minority shareholders are selling low, they might not really have much of a choice given the even bigger discount that the public market is according to PREH. Plus if the consortium gets an extra 7.57%, they would be able to take over the entire company anyway. Current investors should hold on to PREH and accept the offer given by the consortium unless they are in dire need of cash urgently.

When trading reopens, I expect share price to pop to around $0.94-$0.96 to reflect the uncertainty of deal completion and also the additional dividend not accounted for in the $0.95 offer.

What's the next deal that could happen?

With market weakness setting in, real estate players continue to be trading at large discounts to NAVs and thus could be prime candidates for privatization (as the PREH deal shows). Off the top of my head, I recall that UIC's free float is around 11-12% and this is really close to the regulatory minimum of 10%. There has long been talk of privatizing UIC by controlling shareholder UOL however such talks were always quashed by the rivalry between UOL and the other substantial shareholder, the Gokongwei family. This rivalry could have softened with the passing of patriarch John Gokongwei in end-2019. I will address this potential in another post so stay tuned!

0 comments