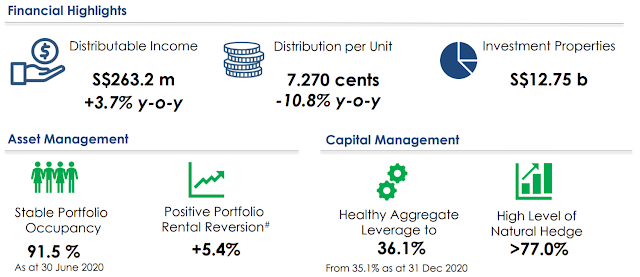

Ascendas REIT announced their results about 2 weeks ago and reported a 3.7% growth in distributable income but a 10.8% yoy decline in 1H20 DPU. Broadly speaking results were seen as positive despite the Covid-19 pandemic raging on in other sectors. Positive rental reversions, especially in business parks, were encouraging and gearing of 36.1% continues to provide AREIT with a healthy debt headroom for acquisitions. In this article, I would like to focus on key points brought up during the analyst briefing that investors may have missed if they merely looked at the announcements on SGX.

|

| AREIT 1H20 results highlights (Source: AREIT) |

1. Positive reversions in the face of weakening outlook not weird at all

At first glance, it seems weird that AREIT could report +4.0% positive rental reversions in Singapore and +4.3% for the total portfolio despite the weakening outlook. However, management has revealed that a number of these discussions had already started taking place before Covid-19 hit and that properties were also under-rented relative to market. The positive reversions represent a mark-to-market of expiring rents rather than an actual growth in market rents.

In particular, the management highlighted business parks as a bright spot with multiple instances of 20%+ reversions. The specific example given was that of an international bank renewing its lease at Changi Business Park for >20% reversion on a new 3-year lease for the same space (no reduction or expansion in space). CEO also highlighted that this was a positive read-through for the business park segment.

For the rest of FY20, the management has guided for mildly positive rental reversions but cautioned that this was not indicative of the direction that the market was moving in. A better gauge could be looking at occupancies instead.

|

| AREIT rental reversions (Source: AREIT) |

2. Logistics demand more transient in nature

Much has been said of the new-found stability and strength of logistics tenants that support e-commerce and Covid-19 related stockpiling. However, during the analyst briefing, AREIT did not believe that those 2 would drive the logistics sector much higher.

Firstly, Covid-19 related stockpiling appears to be done on leases <1 year. Therefore, should the pandemic subside, landlords could see a decline in demand for such spaces. In the short term, we can probably see an improvement in rents from such short leases as they tend to be higher than leases with longer commitments. Such short leases also did not really have an impact on rental reversions as reversions only account for renewal leases >12 months.

Next, while e-commerce has been doing well, it does not make up the bulk of leasing demand for logistics spaces. Instead, AREIT CEO mentioned multiple times that logistics demand in Singapore is driven by contract manufacturing and ~80% of it serves international markets. Therefore, the key catalyst for logistics would be whether Singapore can continue to attract contract manufacturers here and if product demand remains at current levels.

Generally, excluding the transient demand from Covid stockpiling, the management said that the new take up is weaker and occupancy could trend down in the near future.

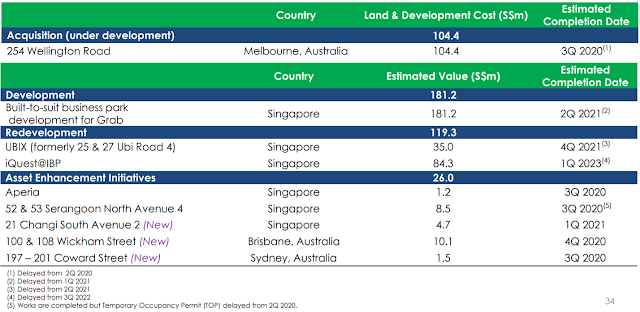

3. Acquisitions and AEIs, while delayed, continue to be on the cards

It should come as no surprise that AREIT is reporting delays in the estimated completion dates for its AEIs and redevelopments due to the outbreak at the foreign worker dormitories. Nonetheless, asset enhancement plans continue to be on track and AREIT also announced 3 new AEIs (2 in Australia 1 in Singapore).

There were also questions on potential acquisitions from the sponsor in Singapore and also overseas. Due to the sensitive nature of such transactions, management could only give very broad motherhood statements; they continue to be interested and have conversations with the sponsor and are doing what they can to unlock opportunities. Deals are coming back and it seems like we may see an overseas one before anything local; anyway, AREIT already did 25% of Galaxis earlier this year.

In terms of strategy, AREIT maintains that it would focus on sectors that drive economic growth like tech and bio-med. In the UK they continue to like logistics and business parks. They also continue to monitor opportunities in data centres. AREIT has a sizeable exposure to data centres from an absolute GFA perspective, however it does not pop out as much due to AREIT's size. Singtel (one of their top 10 tenants) leases data centre space from AREIT. From a pricing standpoint, the management highlighted that lower interest costs also improved the holding power of sellers and hence AREIT is not really seeing any 'Covid-pricing' yet.

|

| AREIT AEIs in progress (Source: AREIT) |

4. DPU decline despite no retention and outlook

One analyst asked about a decline in DPU to around 3.6cts per qtr vs 4.0cts per quarter in 2019. This appeared odd given that AREIT did not retain any income and that the US acquisition in 2019 was supposed to be DPU accretive (+0.7%). To this question, the management highlighted that there were certain one-off distributions in 2019 like the rollover adjustment that contributed to about 0.25cts of distribution. 2020 results also had to account for rental reliefs given to tenants due to Covid-19 and also declines in occupancies leading to lower operational results.

Looking ahead, one area that AREIT is poised to reap some savings is on interest cost. AREIT has some perps coming up on their reset date and whichever option it chooses to take (reset, refinance, issue bonds), AREIT is confident that there will be interest cost savings. Apart from this, most of the outlook really depends on how the Covid-19 virus progresses.

In comparison to its Capitaland peers, AREIT has outperformed and even hit above $3.50 last week. Due to this, and the fall-off of CMT, AREIT remains the largest and most liquid REIT in Singapore. Trading at ~1.6x P/B and 4.3% FY20F yield, AREIT is in a good position to continue its growth via acquisition strategy. On the flip side, its size also means that acquisitions won't really move the needle much and AREIT does have to make portfolio-size acquisitions to continue its growth trajectory.