Yesterday both Keppel DC REIT (KDCREIT) and Mapletree Industrial Trust (MINT) released their results for the quarter ending Jun2020. Both REITs have performed strongly after their end-Mar lows due to their exposure to data centres. MINT has performed more strongly even though it only has a 32% exposure (by AUM) to data centres vs KDCREIT's 100% exposure. I think this could be due to the more visible growth pipeline of MINT from its sponsor's stakes in the US data centres and also redevelopment opportunities at its existing non-DC assets.

KDCREIT Results

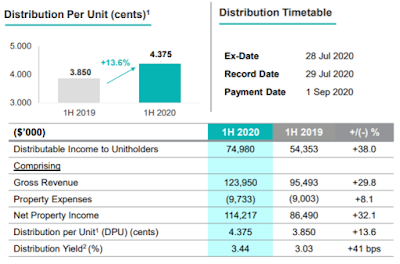

KDCREIT reported a 1H2020 DPU of 4.375 Scts which as a 13.6% improvement yoy. This was due to new acquisitions of SGP4 and DC1 in 2019 as well as the latest acquisition of Kelsterbach DC in May 20. Based on the 1H2020 closing price of $2.54, this represents a 3.44% annualised distribution yield. As all of KDCREIT's tenants are in the data centre business, they were not subject to any shutdowns and hence did not require any rental reliefs/support from KDCREIT. KDCREIT was thus able to payout 100% of its distributable income.

|

| KDCREIT Results (Source: KDCREIT) |

MINT Results

For MINT, it reported a 1QFY20/21 DPU of 2.87 Scts which was 7.4% lower yoy due to rental rebates extended to tenants due to Covid-19 as well as holding back tax-exempt income of S$7.1m to mitigate the impact of mandated rental reliefs. According to MINT, if such income was not withheld, DPU would have been 3.19 Scts, representing a 0.09 Scts increase yoy. The amount held back was about 10% of its 70.6m distributable income.

|

| Breakdown of sub-asset classes by AUM (Source: MINT) |

In my opinion, MINT continues to be held back by its legacy portfolio of flatted factories and older business parks as shown in the negative rental reversions as well as lower new rents achieved during the period. However, investors could possibly see this as 'land bank' to be redeveloped into more future-ready assets. Given MINT's management's strong execution track record, there could certainly be more redevelopment opportunities like 30A Kallang Place and Kolam Ayer.

|

| MINT Rental Rates (Source: MINT) |

It is hard to overstate the attractiveness of the data centre asset class during the Covid-19 period where businesses have been forced to digitize and people have been working from home. More importantly from a real estate perspective, data centre leases tend to be long (KDCREIT's WALE of 7.4 years) and provide a steady stream of income so long as service level agreements are met.

At their current trading levels, it appears that both KDCREIT and MINT are in a virtuous cycle as their trading yields (3-4%) are much lower than data centre cap rates (5-7%). This would allow them to make accretive acquisitions even with a greater proportion of equity funding. In turn, this growth potential can further drive up the share price and make it even easier for either to make accretive acquisitions.

Investor optimism has certainly showed up in their strong price growth and I believe that investors are pricing in additional acquisitions. Therein lies a certain amount of risk if the REITs are unable to find assets to acquire and meet investor expectations.