Ascott

Residence Trust (Ascott) owns 88 hospitality properties across 15 countries

globally with a range of offerings like serviced residences, hotels and rental

housing. Post-merger with Ascendas Hospitality Trust in 2019, it is currently

the largest hospitality trust in Asia Pacific and has a market capitalization

of S$3bn and S$7.4bn of assets under management. We think that its share price

has been beaten down badly by the Covid-19-induced market turmoil and offers

investors good value due to:

Highly geared to domestic travel rebound

As economies gradually reopen, governments are encouraging domestic

travel to revive their fallen hospitality sectors as borders remain tightly

controlled. Given Singapore’s small size and population, domestic travel has a

far smaller role in reviving our hospitality sector, in our opinion. We

therefore think that more globally diversified hospitality stocks like Ascott,

which has exposure across 15 countries, could be more geared to the recovery in

domestic travel.

For example, in Japan, which contributes 12% to Ascott’s FY19 gross profit, the government has announced a campaign to stimulate domestic travel by offering subsidies of up to 20,000 Yen per day through discounts and vouchers for hotels and attractions for residents taking domestic trips.

|

| Ascott Residence Trust income diversity (Source: Ascott) |

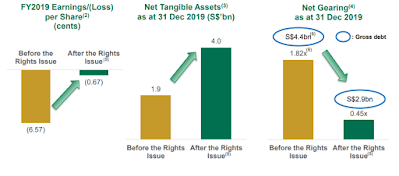

Strong balance sheet positioning it for growth

Ascott has a strong balance sheet due to its 35.4% gearing which implies a S$2.1bn debt headroom before reaching the 50% regulatory limit. It has ~S$300m cash on hand and will be receiving an additional S$163m cash proceeds from the divestment of Somerset Liang Court in 2H20. This strength could allow it to make opportunistic acquisitions, from either third-parties or its sponsor, without an equity fund raising at a time when property valuations could be taking a hit due to the lower cashflow projections from valuers.

Apart from inorganic growth, Ascott’s strong

balance sheet allows it to undertake development and asset enhancement projects

without putting too much strain on its financials. Examples include the

development of lyf@one-north, and the redevelopment of Somerset Liang Court.

|

| Somerset Liang Court (Source: Ascott) |

EPRA NAREIT Index inclusion

One of the benefits highlighted by Ascott for the merger with Ascendas

Hospitality was the potential for inclusion into the EPRA NAREIT Developed

Index which could lead to a wider investor base (higher visibility) and higher trading liquidity.

Despite the decline in Ascott’s share price, its market cap of $3bn allowed it to qualify for index inclusion in Jun20. We think that the inclusion could be a

further boost to Ascott’s share price due to inflows from institutional funds, like

what FLT and KDCREIT experienced when they were included in 2019.

Key risks to be aware of

As only 11% of its FY19 gross profit is derived in S$, Ascott is exposed

to FX risks if the S$ significantly

appreciates against the basket of foreign currencies Ascott has exposure to. Additionally,

like most other businesses, Ascott would also be negatively impacted if the downturn from Covid-19 is longer than expected or if a second wave of

infections materializes.