Sembcorp Marine recapitalization: Not the endgame for Temasek

Earlier today Sembcorp Marine (SCM) announced a recapitalization of S$2.1bn via a rights issue of 5 SCM rights shares for every SCM share currently outstanding at an issue price of S$0.20 per rights share. The amount raised will be supported by an undertaking by Sembcorp Industries (SCI) and Temasek to subscribe for up to S$1.5bn and S$0.6bn respectively.

What is Temasek's endgame

It would be interesting to see what Temasek is planning for SCM as orders have been declining over the past few years since the industry downturn started in 2014. Last year, Temasek did a partial offer for Keppel at $7.35 during which there was chatter that there might be some sort of reorganization of Temasek's offshore marine portfolio by potentially merging Keppel O&M and Sembcorp Marine. There could also be some reorganization of the various portfolios under Keppel and SCI as both do have some other overlapping areas like renewables and infrastructure.

My guess would be that Temasek consolidates the various industries that Keppel and SCI have such that each can be a national champion in that particular area rather than having overlapping competencies and thus having redundancies from a national standpoint. Interestingly, Keppel also released its 2030 vision a while back and this came before the completion of Temasek's partial offer (expected in 3Q2020).

With Keppel's partial offer still yet to be completed, my guess is that any further moves by Temasek would come after the completion (expected 2H2020). The current move of recapitalizing SCM and demerging it from SCI helps to simplify the org structure and strengthen SCM's balance sheet. This could make SCM a more palatable target for Keppel to take over once the partial offer is completed.

As this deal makes Temasek a direct shareholder of SCM, I am also wondering if the eventual intention is to privatize SCM. Post-deal, Temasek would own between 30-58% of SCM. My guess would be that Temasek could eventually own ~50% since I expect there will be a number of minority shareholders that do not wish to subscribe to the rights as the industry is declining or shareholders simply do not have sufficient capital set aside for such a large rights issue.

|

| Shareholding post-rights issue (Source: SCM) |

This deal, like the Keppel and SIA deals, has also made clear that Temasek will not hesitate to step in to support its portfolio companies in times of need and could provide further comfort for shareholders of other Temasek-linked companies that this can happen for them if they are in trouble. Whether this deal is good or not is hard to assess without knowing the future steps that Temasek would take.

Deal details

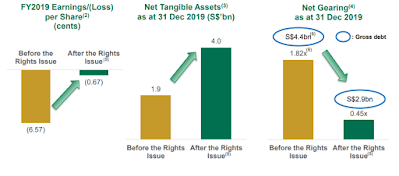

For every 1000 SCM shares owned, the SCM shareholder will need to cough up $1,000 to subscribe to the 5000 rights shares. To maintain their shareholding percentage, SCM shareholders would have to put up more cash than the value of their SCM shares. As of last closing price, 1000 SCM shares would be worth $850 and shareholders would have to come up with $1000. The figure below also shows that this deal is massively dilutive, although in this case, it appears good because SCM was in a net loss position so the loss per share was reduced.

The use of proceeds will be split into the same S$1.5bn and S$0.6bn:

S$1.5bn - To repay outstanding principal on the credit facility of S$1.5bn provided by SCI to SCM

S$0.6bn - For working capital and general corporate purposes

Subsequent to the rights issue, there would then be a distribution of SCM shares by SCI to SCI's shareholders. SCI shareholders would receive between 427 and 491 SCM shares for every 100 SCI shares they own.

Why this is being done

To enhance SCM's balance sheet by deleveraging and lowering interest expense while also doubling its Net Tangible Assets from S$1.9bn to S$4.0bn. This would allow SCM sufficient capital to compete for more projects.

|

| Pro-forma financial impact of recapitalization (Source: SCM) |

What shareholders need to do

SCM shareholders need to decide on whether to approve the rights issue and whitewash resolution separately. For the rights issue, it appears that it is a given granted SCI has >50% and will be voting in favour. Minority shareholders will have more say in the whitewash resolution for the proposed distribution. If the resolutions are approved, SCM shareholders need to decide if they want to sell the rights as they are renounceable or subscribe to the rights for $0.20 per rights share. For every 1000 SCM shares owned, the SCM shareholder will need to cough up $1,000 to subscribe to the 5000 rights shares.

For SCI shareholders, they need to approve the proposed distribution of SCM shares to them. If the resolutions are all approved, SCI shareholders will receive X amount of SCM shares depending on the subscription rate by SCM shareholders.

In effect, since the 3 resolutions are inter-conditional, minority shareholders still have the ability to block this deal.

|

| Shareholder Resolutions (Source: SCM) |

0 comments