Spot on with STI index rebalancing (MINT in, SPH out)

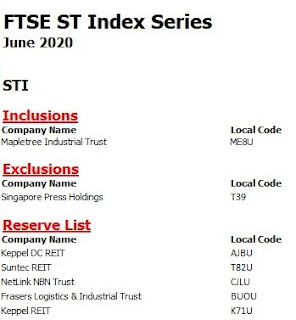

FTSE Russell released the changes to the STI Index following its quarterly review earlier today. Similar to the predictions of the MSCI Index changes, we were spot on again with Mapletree Industrial Trust being added and SPH being deleted. In addition to the index rebalancing, the new reserve list, by market cap, is as follows, FLCT replaces MNACT:

|

| STI Index Inclusions & Exclusions (Source: FTSE Russell) |

As explained in the first post about the STI Index rebalancing, the criteria and method of calculation for the index is publicly available from the index provider (FTSE Russell) so it is not difficult for any layman to do such calculations beforehand; it just takes some time to do so.

After this announcement, investors should take note that the changes will be applied at the close of business on 19 Jun and will be effective on 22 Jun. While the STI Index is less traded compared to the MSCI Singapore, we still think that the fund flows as a result of the rebalancing could have an impact on share prices. MINT could go up due to fund inflows on 22 Jun while SPH should see outflows then. Interestingly, SPH was part of the group that created the STI index.

For MINT, its share price has bounced back to what it was at the start of 2020. With such a high premium to book value (1.7x P/B), it could continue to make larger acquisitions funded by equity.

Looking ahead, we are cognizant that CCT will be deleted from the index after its merger with CMT, upon which KDCREIT could take its place as the stock in the reserve list with the highest market cap. However, with Covid-19, the merger could face delays so this rebalancing may not happen so soon.

0 comments