Earlier this morning, Mapletree Industrial Trust (MINT) announced the acquisition of 60% stake in a portfolio of 14 data centres in the United States. Pre-acquisition, MINT held a 40% stake it acquired in 2017 together with its parent, which acquired 60%. Post-acquisition, MINT will own 100% of the portfolio and its exposure to the US will increase to 32.5%; data centres will now make up 39% of its portfolio.

|

| MINT Portfolio Breakdown (Source: MINT) |

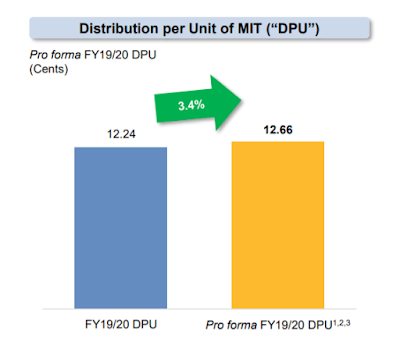

The portfolio is an extension of what it already has and improves the stability of MINT's income with a long WALE of 4.6 years, occupancy of 97.4% and less than 20% of leases expiring in the next 3 years. I think this plays very nicely into the whole data infrastructure trend that Covid-19 has accelerated. Importantly for shareholders, the acquisition is DPU accretive by 3.4% on a pro-forma basis. While minority shareholders could have their % stakes diluted somewhat by the placement, I think that this is largely irrelevant as DPU continues to grow and individual shareholders really don't own that much %-wise.

|

| MINT DPU Accretion (Source: MINT) |

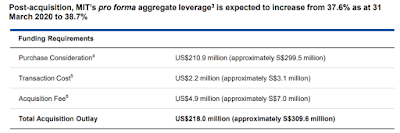

The S$299m acquisition will be fully funded by a placement exercise which aims to raise at least S$350m with an upsize option for another S$50m. The issue price range of S$2.732 and S$2.800 implies a 5.0-2.6% discount to its VWAP (volume-weighted average price) of S$2.8745.

It has a forward trading yield of 4.3% which explains why it was able to make a fully equity funded acquisition 3.4% DPU accretive on a pro-forma basis. Typically, large acquisitions would have to be funded via a mix of debt and equity as asset yields would be lower than stock trading yield. But in this case, it appears that MINT's 4.3% FY20F yield is lower than the data centre portfolio's yield. Based on past reports, data centre yields are between 5-7%.

MINT is raising more than it requires with S$302.6m out of the S$350m going to the acquisition and the remainder being applied to pay off debt or kept for working capital purposes. While the general market is still reeling from the Covid-19 situation, MINT has performed well and is using its strength to raise more capital. Interestingly, even though it fully funded the acquisition by equity and even raised more than it needs, MINT's proforma aggregate leverage is expected to increase from 37.6% to 38.7%.

|

| MINT use of funds (Source: MINT) |

Overall I think this is a good acquisition for MINT and shows that it is making full use of its strong share price to raise capital. It was trading at almost 1.8x P/B before it was halted this morning. This acquisition also reminds the market of the importance of having a strong sponsor that can support the REIT in tough times with a growth pipeline. I believe that MINT would not have been able to make a deal with a 3rd-party in this climate as asset-owners continue to cling on tightly to data centre assets.

Looking ahead, MINT continues to have a growth pipeline in the form of the 2nd and 3rd data centre portfolios that it acquired in 2019 together with its sponsor. Like the current redwood acquisition, I believe that it is only a matter of time before MINT can acquire those sponsor stakes too. In addition to an acquisition-led growth in data centres, MINT could also continue to redevelop its old flatted factories (~22% of portfolio) into high-spec properties just like what it is doing at Kolam Ayer.

0 comments