ESR-Sabana Merger: Acquisition trial continues

This morning ESR REIT announced a proposed merger with Sabana REIT.

Transaction details

0.94 new ESR REIT units for every 1.0 Sabana units held. This is an all-stock deal with no cash consideration to be paid out (unlike the previous ESR-Viva deal). ESR units would be issued at an indicative price of $0.401 (vs last traded at $0.39) while this implies a $0.377 price (vs last traded $0.36) for Sabana units.

Rationale

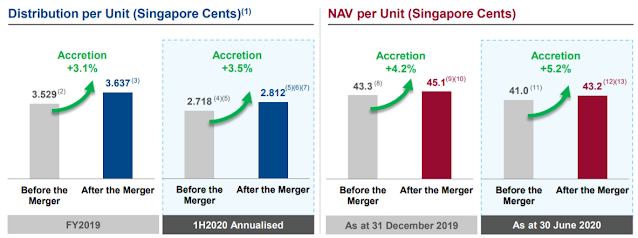

1. DPU and NAV accretion - According to the pro-forma, this would be DPU accretive to ESR REIT shareholders by 3.5% while Sabana shareholders would enjoy a 12.9% accretion. What is slightly positive to unitholders is that any income retained would have to be paid out before the effective date of completion. In the past quarter, DPU was affected due to amounts retained for Covid-related purposes.

The higher accretion by Sabana could also be a function of the management fees being 60% paid out in units vs 100% cash previously as the pro-forma assumes that Sabana's fee structure follows that of ESR's. Looking at the fee structure, the base fees are both 0.5% of the deposited property. There could be some savings from the performance fee perspective as ESR has a high watermark of 6 cents DPU (following which perf fees is 0.25% of the increase) which it is unlikely to hit in the next few years vs Sabana's 0.5% of NPI if DPU grows by 10%. ESR also has a lower trustee fee of 0.1% of deposited property vs 0.25% for Sabana.

One point to note is also that the enlarged REIT would not be maintaining its Shariah compliance so this could save additional costs. According to Sabana management, they have been reviewing the Shariah compliance over the years as it appears that the cost of compliance has outweighed the benefits from having an additional pool of investors.

2. Shift in portfolio exposure - The merger will allow the enlarged ESR REIT to have greater exposure in high-specs and logistics properties. I think this is a positive as high-spec properties have enjoyed strong demand due to their future-ready characteristics while logistics properties have been the flavour of the year given the increased need for logistics services during lockdowns.

|

| Sub-asset class exposure (Source: ESR REIT) |

3. Operational synergies - The REIT Manager posits that the merger could bring about operational synergies from a marketing and leasing perspective. There could also be cost savings due to consolidation of contracts and stronger bargaining power as a result of becoming a larger entity. While I agree with this in theory, in practice, we have yet to see major cost synergies from the previous ESR-Viva merger. This could be due to maintenance contracts not expiring. Also in relative terms, Sabana increases the estimated GFA by about 27%, so not that sure how much incremental benefit ESR can extract out of the merger.

4. Size and cost of capital - To me this is one of the strongest rationales for the merger. As a larger and more established entity, ESR REIT would be able to secure more competitive rates from both the banks and the market. Evidence of this is already provided when it managed to refinance Sabana REIT's debts and reduce the cost of debt from 3.8% to 2.5%.

|

| ESR REIT cost of debt (Source: ESR REIT) |

In theory, I believe that this is possible, the true extent of the savings is hard to estimate without further disclosure from the REIT. The lower rates are probably also a function of the lower base rates in 2020 and then slightly offset by the longer debt tenor and the lack of encumbrances. Best is if we know the interest margin pre and post refinancing.

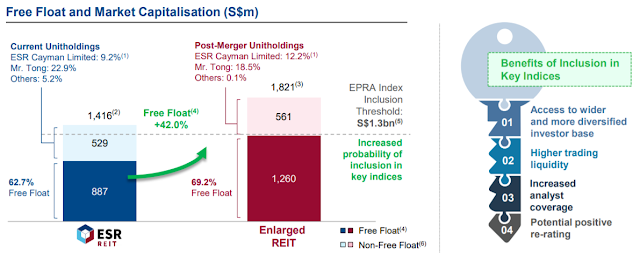

On the equity front, I am excited that the larger free-float market cap promised by the merger could possibly lead to inclusion in the EPRA NAREIT Index. Index inclusion has been a strong driver of REIT share prices in 2019 and I think the benefits of a re-rating cannot be overemphasized. For the longest time, ESR has had trouble being included as its largest shareholder, Mr Tong Jinquan, did not want to reduce his holdings in the REIT. While this was a testament to his confidence in the REIT, this also prevented the REIT from accessing a greater pool of investors that comes with index inclusion. With the completion expected to be in Nov20, the earliest that ESR can be included (assuming it hits the threshold) is probably going to be in 1Q21.

|

| ESR free-float market cap (Source: ESR REIT) |

Thoughts

Generally quite positive on the merger as I believe the larger platform can bring about most of the benefits that ESR purports it can. Looking at prices, there has been a divergence in the performance of larger market cap REITs vs small/mid cap ones and pushing itself to become a large market cap REIT is a step in the right direction.

One big problem ESR always had post-Viva merger was the high gearing. As of 1H20, its gearing is 41.8% and in the merger announcement, it mentioned that its pro-forma gearing would be 41.7%. Which is weird if I look at the sources and uses since it appears that ESR is funding the deal 54% equity 46% debt. Implicitly I would have expected gearing to go up. Either way, the higher MAS gearing limit of 50% probably gave management sufficient comfort that they had some buffer if valuations come down even more. Pre-merger ESR also did a revaluation of its assets and thankfully the decline was <2%.

|

| Merger Sources & Uses (Source: ESR REIT) |

Overall my stance remains that both sets of shareholders should vote for the deal as the larger platform would help. For shareholders that do not approve (or are unable to continue holding the REIT due to the lack of shariah compliance), they should sell their shares.

0 comments