SPHREIT released its 3QFY20 Business Update this evening. This comes after it shifted to half-yearly reporting; the link to the presentation can be found here. Would like to highlight a few things to take note of:

1. DPU continues to be low but may not be because of a low payout ratio

SPHREIT declared a DPU of 0.5 Scts for the quarter representing an increase over 0.3 Scts declared in the last quarter. However, it did not disclose its distributable income hence we are unable to accurately calculate what the current payout ratio is. If we take last quarter's results, this represents a payout ratio of 33%, up from 20% previously.

In all likelihood, 3Q distributable income would have been significantly worse off than 2Q as the quarter covered Mar-May which were the months which felt the most impact from Covid-related mall closures. Additionally, SPHREIT also announced that they were giving rental waivers for tenants. Therefore, the reduced DI would mean that payout ratio is probably more than 33%.

2. Gulf in prime and suburban not as big

My original thesis was that prime district malls in Orchard//City area like Paragon would suffer substantially more than suburban retail due to the target audience. Apart from having a bigger residential catchment, suburban malls typically tend to have a larger proportion of 'essential' tenants like supermarkets and F&B. Whereas prime district malls tend to have a larger percentage of high fashion and targets discretionary and tourist spend. Therefore I expected suburban malls to be substantially more resilient.

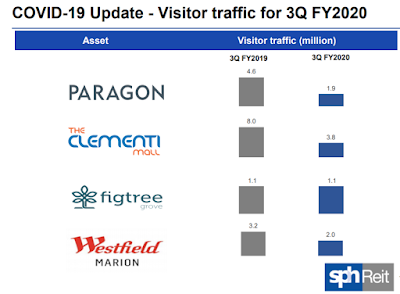

Looking at the visitor traffic figures, Paragon experienced a 58% decline in traffic while Clementi Mall's traffic declined 53%. Would have thought that the difference would be much bigger. My guess would probably be that pre-Covid Paragon was not overcrowded whereas Clementi Mall is frequently packed to the brim. Hence with a higher base there was much more room for traffic to fall at Clementi Mall.

|

| SPH REIT Footfall (Source: SPH REIT) |

3. Occupancy remains high but what about rental reversion?

SPHREIT reported a committed occupancy of 98.8% across its malls in Singapore and Australia. Importantly, its 2 largest revenue contributors had occupancies of >99%! I think this is impressive as it probably implies only 1-2 shop lots are vacant. Going forward both Paragon and Clementi Mall have 28%/22% of lease renewals in FY21 and this will be a critical point to watch as leases do take time to expire. I also note that SPHREIT did not disclose its rental reversions in the presentation pack. We are therefore unsure if the high occupancies are a function of cutting rents.

In the down-cycle that is coming, I believe that landlords will do well to shore up occupancy even if it is at the expense of rental rates. Unlike rental rates, occupancy is binary, either you are getting income from that shop lot or you are not. However, do hope that the REITs can be transparent in sharing such figures so that unitholders are well-informed.

|

| SPHREIT Occupancy (Source: SPHREIT) |

1 comments

If a company hide critical information, best to avoid.

ReplyDelete