Following the private placement by MINT to acquire the remaining 60% of its first US Data Centre portfolio, other REITs with strong balance sheets made moves recently.

Ascendas REIT

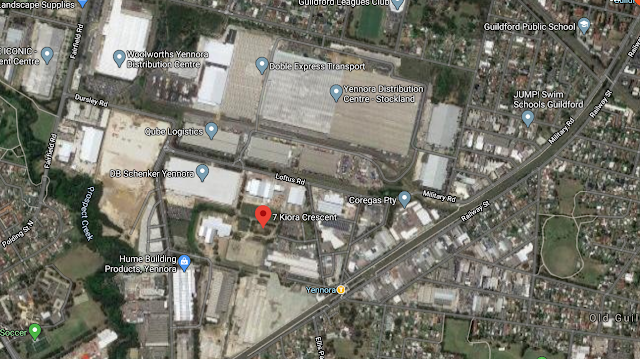

AREIT announced the acquisition of a yet-to-be-built logistics property in Sydney today (1 Jul 2020) for A$23.5m. The property will be developed by the Vendor and completed by 2Q2021. In the press release, AREIT mentioned that it managed to acquire the property at an almost 20% discount to its 'as if complete' valuation and this implies a 1st year NPI yield of 6.2%/5.8% pre and post-transaction costs.

With a huge portfolio across Singapore, Australia and the UK, this acquisition barely moves the needle although AREIT says it is accretive to DPU. To unitholders, the REIT is also taking on development risk as the property is uncompleted and does not have a tenant. To mitigate this risk slightly, the Vendor is providing a 9.5months rental guarantee.

REITs taking buying uncompleted assets or taking part in development means that their capital is tied up but not generating any income for unitholders (ie. not so efficient). However, as this acquisition is small, I do not think that there will be any noticeable impact on AREIT. Additionally, this method allows AREIT to gradually build up its portfolio accretively as they are unlikely to get good yields on completed (and fully tenanted) assets. The acquisition is expected to be fully funded by debt or internal resources hence the ability to get yield accretion.

|

| Google Map View of the acquisition (Source: Google) |

Frasers Centrepoint Trust

The more sizeable acquisition was made by FCT's acquisition of an additional 12% interest in the PGIM ARF Fund for S$197.2m. This brings its interest in the fund to 36.89% from 24.82%. As a recap, the PGIM ARF Fund contains 5 retail malls and 1 office property in Singapore and 1 retail mall in Malaysia. Ever since FCT and its parent, FPL, started buying stakes in the Fund, their intention was always to absorb these malls into FCT eventually.

According to FCT, this transaction will be DPU accretive on a pro-forma basis by +0.13%. The transaction will be fully debt-funded and would cause gearing to rise from 32.9% to 36.2% on a pro-forma basis.

I like the transaction as it continues FCT's push to eventually own the entire Fund. The properties are all sub-urban retail which plays nicely into the Covid-19 resilience theme vis-a-vis prime district malls. Looks like FCT will continue to make bite-sized acquisitions of stakes in the Fund going forward.

As mentioned in my previous post, I like the growth pipeline for FCT. Other than the PGIM ARF fund, it also has additional stakes in Waterway Point and Northpoint City that it can acquire going forward. A possible benefit of acquiring 100% of PGIM ARF is that FCT could then do away with the Fund structure and have these assets directly under FCT. This would save unitholders one level of fees; currently, I believe that unitholders are being charged fund management fees by PGIM ARF and REIT manager fees from FCT for every dollar that the PGIM assets generate.

Both the AREIT and FCT transactions again emphasize the importance of having a strong balance sheet. For AREIT, it is large enough that bite-sized transactions can still be done without making too much of an impact on its balance sheet. While for FCT, it had always maintained one of the lowest gearing ratios historically, which allowed it to take advantage of opportunities when they arise.

0 comments